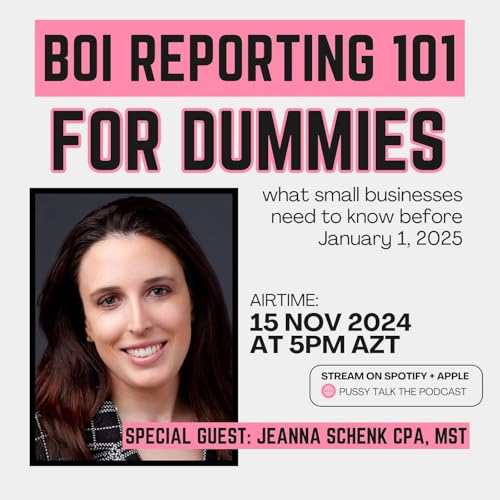

BOI Reporting 101 What LLCs Need To Know

Failed to add items

Sorry, we are unable to add the item because your shopping basket is already at capacity.

Add to cart failed.

Please try again later

Add to wishlist failed.

Please try again later

Remove from wishlist failed.

Please try again later

Follow podcast failed

Unfollow podcast failed

-

Narrated by:

-

Written by:

About this listen

Send us a text

Starting January 1, 2024, many businesses are now required to comply with the Corporate Transparency Act which requires the disclosure of the beneficial ownership information (“BOI”) of certain entities from people who own or control a company. The goal of this new requirement is to help combat money laundering, terrorism, and other illegal activities.

You Can File For Free At: https://boiefiling.fincen.gov/

Or contact Jeanna Schenk for support.

Jeanna Schenk | CPA, MST

SALT Senior Manager

480.582.9631

Jeanna.Schenk@redw.com

No reviews yet